Best 8 apps to learn how to save from iPhone

Manage your expenses and watch over your financial health with these 8 apps to learn how to save. They are free and available in the official Apple store.

If you find it difficult to maintain your savings or want to better manage your finances, then you should know this list of apps to learn how to save from iPhone.

Manage income that we perceive can be somewhat complicated, considering that there are several expenses that must be made during the month. This situation is quite frustrating especially for those who wish to acquire a high value asset.

Manage your expenses and watch over your financial health with these 8 apps to learn how to save. They are free and available in the official Apple store

Fortunately, there are pocket tools that will not only give you financial advice to regulate expenses, but also, they will help you to avoid new debt.

If you want to avoid doing spending on impulse and buy unnecessary products, we recommend you review these apps to learn how to save from iPhone.

Apps to learn to save from iPhone: the 8 best

- 52 Week Money Saving Challenge

- Digit – Save Money & Invest

- Mint: Budget Planner & Tracker

- PocketGuard:Budget App & Bills

- Prism Pay Bills, Bill Reminder

- Wally: Smart Personal Finance

- Acorns: Invest Spare Change

- Qapital: Find Money Happiness

Below you can see the best apps to learn how to save from your iOS device. With them you can create spending habits according to your goals under a comfortable view of all your accounts.

52 Week Money Saving Challenge

52 Week Money Saving Challenge: a challenge of 52 weeks to save

52 Week Money Saving Challenge is an application designed to perform a 52 week savings challenge. The dynamic consists of saving weekly and gradually increasing the sum of the amount. Or if you wish, start with the highest sum and go decreasing the number every week.

In either case, the goal is that at the end of week 52 you managed to save a total of 1.378 euros.

Best of all, is that the app works with and without internet connection, in turn, is capable of send notifications remembering the goal set by the user through a progress chart.

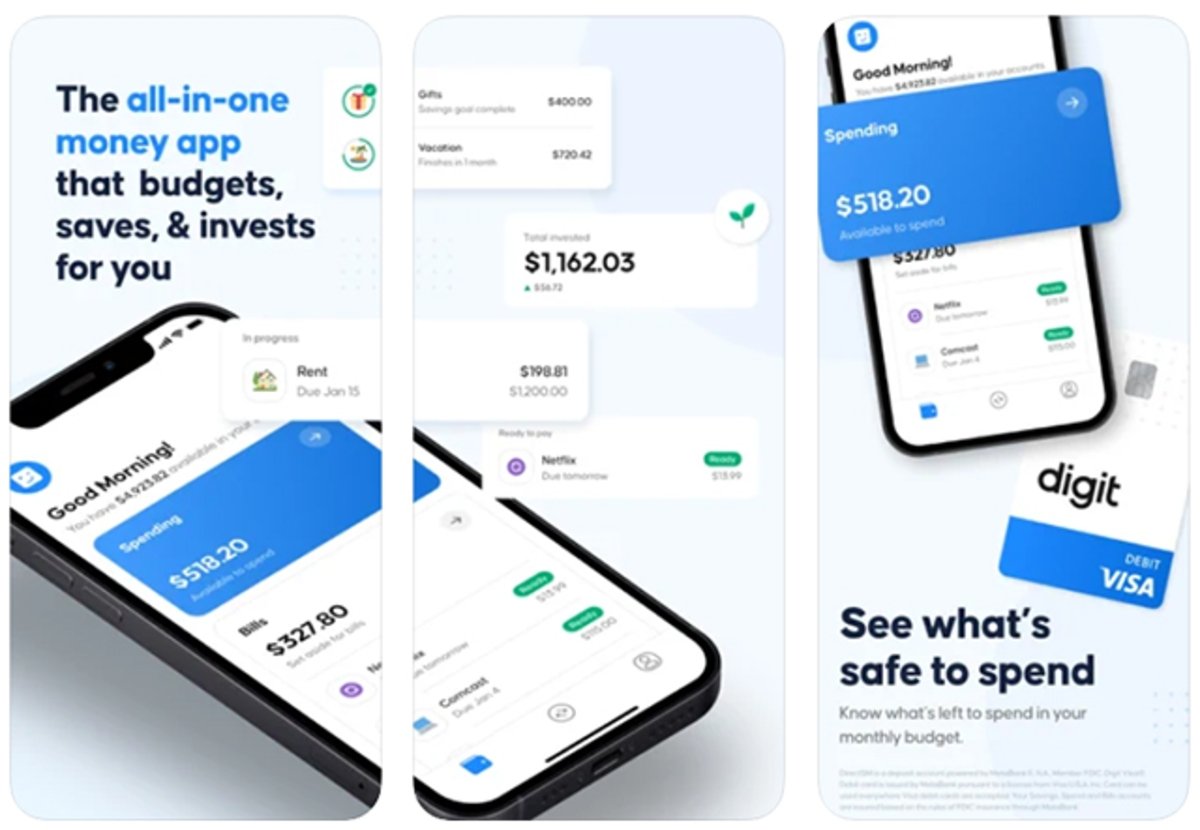

Digit – Save Money & Invest

Digit: Smart Banking and Budgeting

Digit is an app that handles finances for you. All you have to do is schedule fixed monthly expenses (payment of services, rent, car and other consumption) and the application will take care of make payments up to two days before automatically.

In addition, Digit discounts minimum amounts that will go unnoticed at the time, but that in the future will be reflected in a significant savings.

Also, you can set savings goals and the app will work to achieve it in the required time. If you are interested, you can download the application and use it in a free 30 day period, then it will require a payment of 9.99 euros per month.

Mint: Budget Planner & Tracker

Mint: Budget Planner & Tracker

Mint is a virtual assistant who is in charge of managing your finances, managing all your expenses, save money, and keep track of accounts payable. That’s how it is! this great app organize monthly fixed expenses that you enter and notify to make them on time avoiding the interest rate for late payment.

Furthermore, it performs IRS payment refund tracking Y manage the security of your accounts sending security alerts for login attempts. With this application you will be able to observe and keep up to date with the available credit score and many more functions.

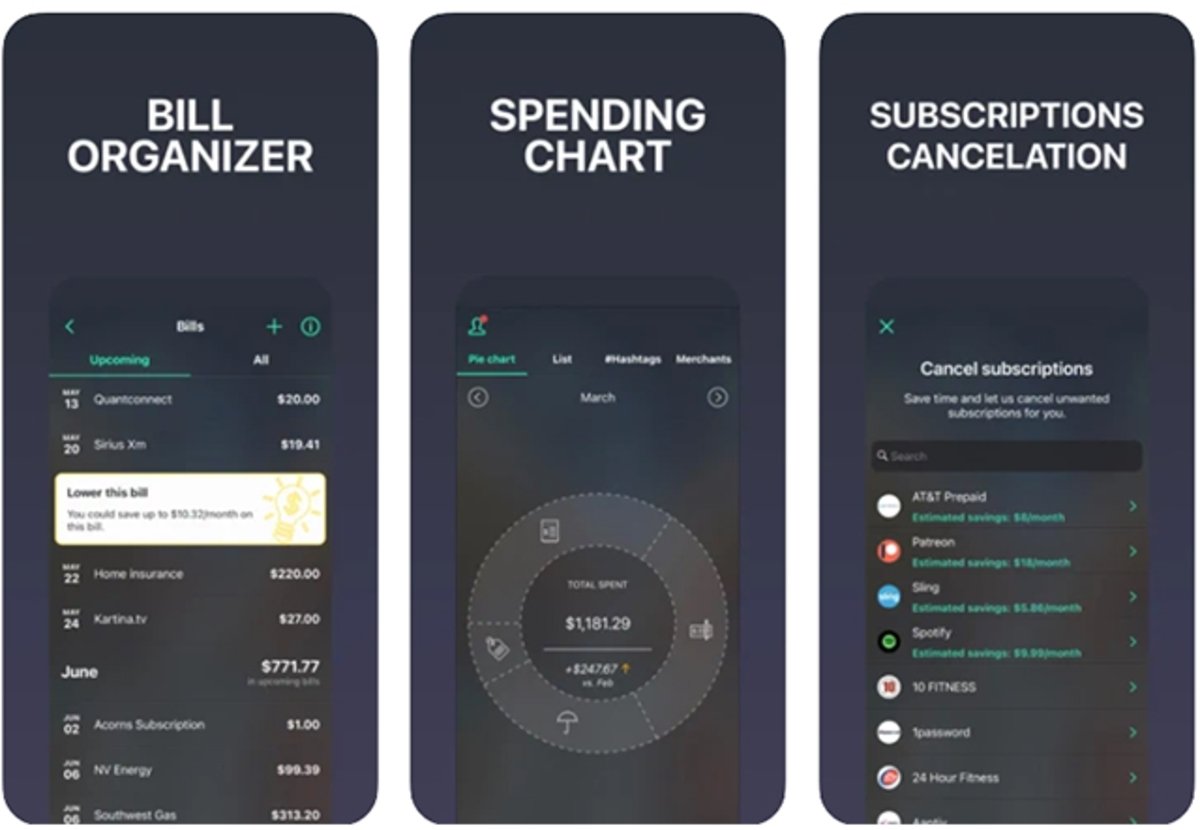

PocketGuard:Budget App & Bills

PocketGuard – Bill Organizer & Budget Planner

If you want to learn to save, then PocketGuard is ideal for you. Is iOS app link all your bank accounts and credit cards in one place and track all your spending to establish a future savings plan.

With it you can see your consumption habits through a pie chart where you will appreciate what are the expenses that take a large part of the cake.

At the same time, Pocket Automatically evaluates the subscriptions in which you are affiliated and if they are not in common use, it recommends disaffiliation. It also sets unlimited goals that allow you to stick to the plan to achieve a secure savings.

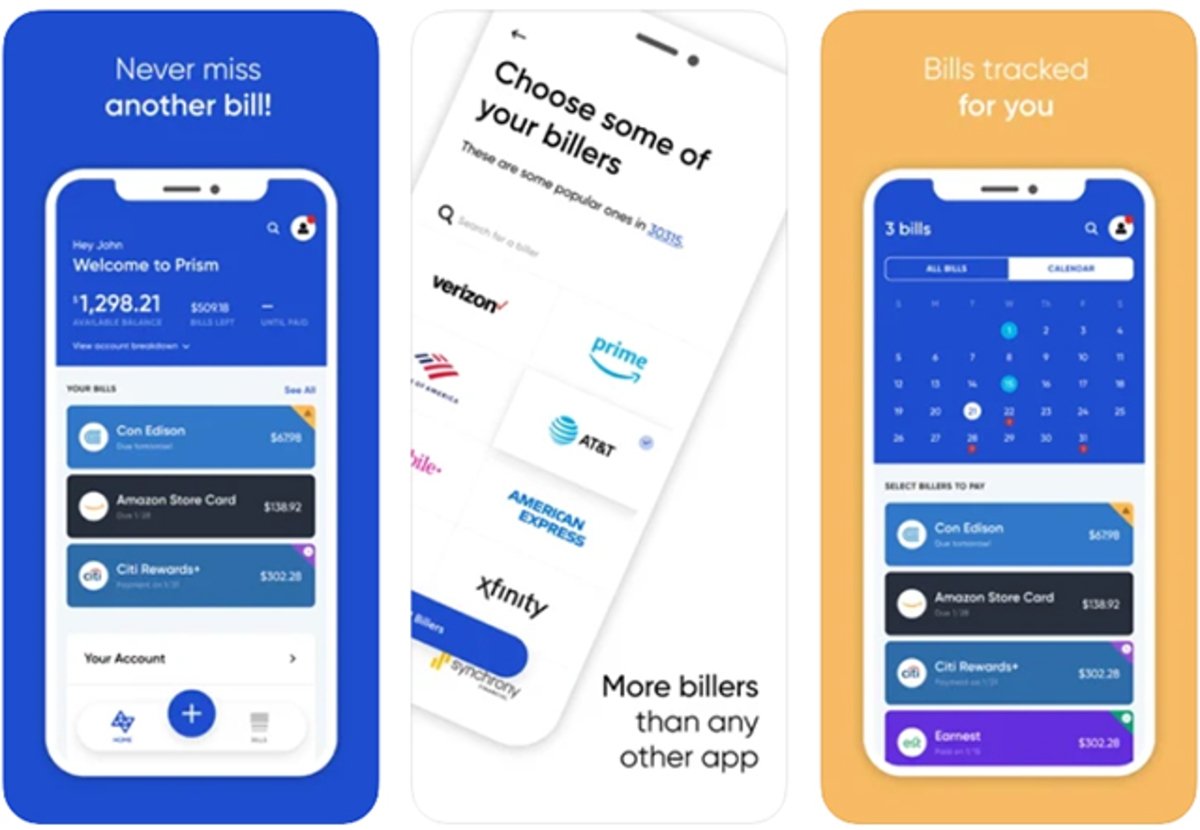

Prism Pay Bills, Bill Reminder

Prism Pay Bills – Money Manager & Spending Tracker

Prism Pay Bills, Bill Reminder is an application where you can view your capital available in your accounts under a single interface, that is, without the need to log in to multiple accounts. Receive notifications of accounts payable and make payments on time.

Is very comfortable to wear and it has easy to understand graphics accompanied by all payment history made. A completely platform safe and practical to learn to control your finances and above all to save.

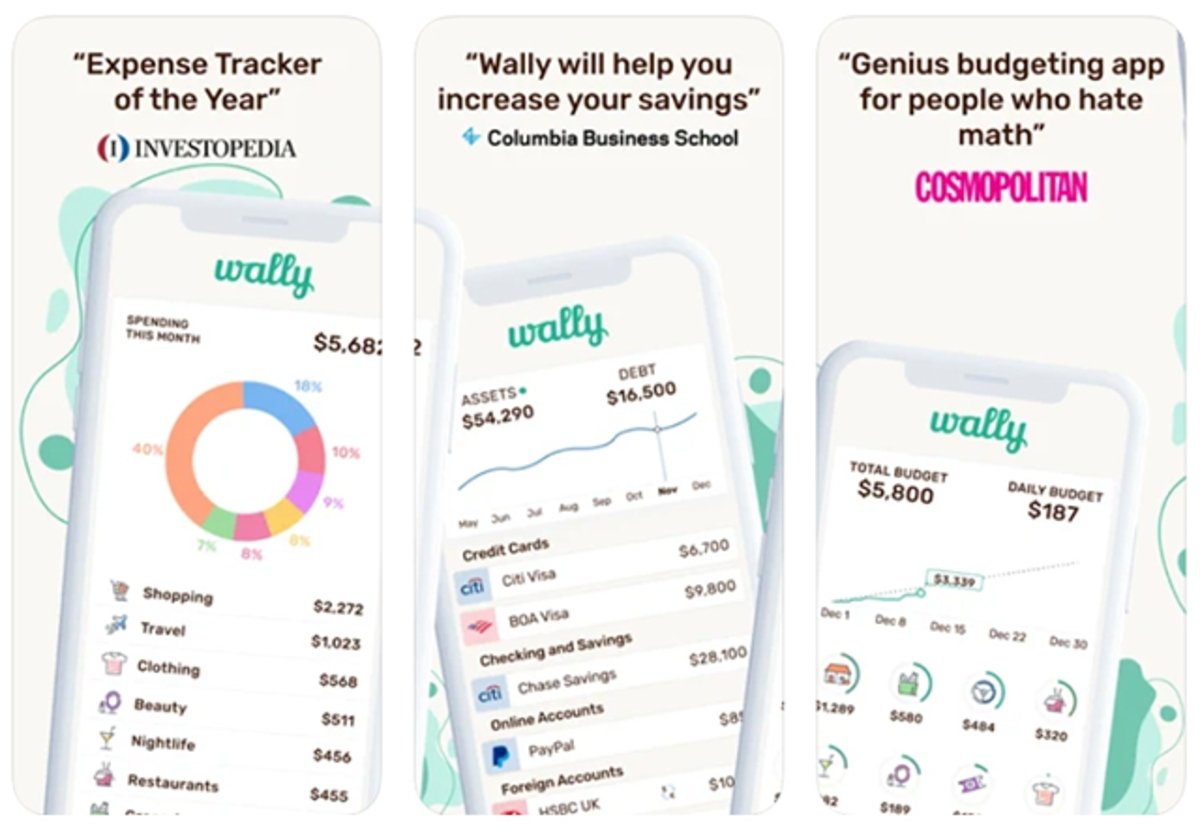

Wally

Wally: Smart Personal Finance

Organize your accounts of national, foreign currency and cryptocurrencies with the application Wally. With this system you will be able to track expenses for up to 2 years and verify your net balance in your asset and liability accounts together.

In addition, this software is capable of performing a track your monthly expenses and even set goals and budgets to improve your finances.

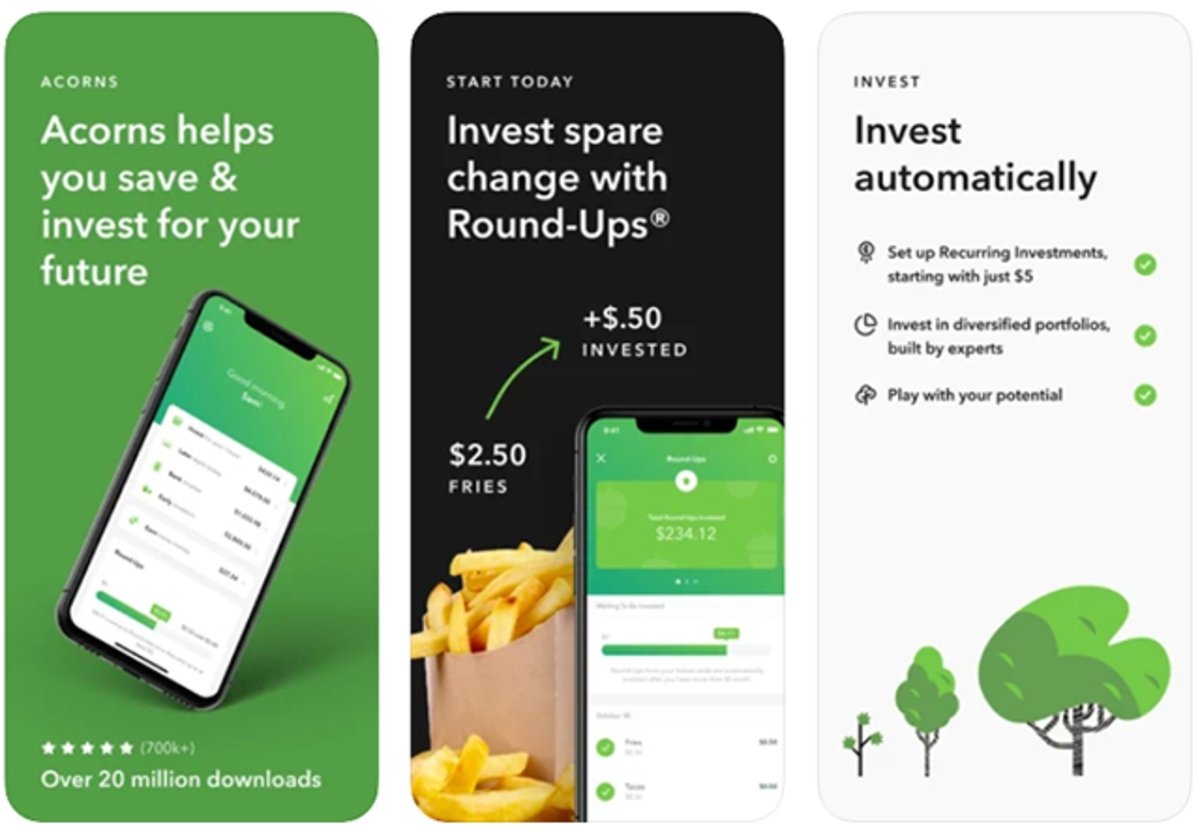

Acorns: Invest Spare Change

Acorns: give your money a chance to grow

An app that thinks about the welfare of your future. Through it you can build your own retirement savings, setting up an EFT account and forgetting about it. And it is that Acorns will automatically discount minimum payments that will accumulate over time for your retirement savings plan.

Likewise, it has a savings system to ensure the future of your children through a UTMA/UGMA account for children. Learn about finances in an educational space and join the experience in Acorns.

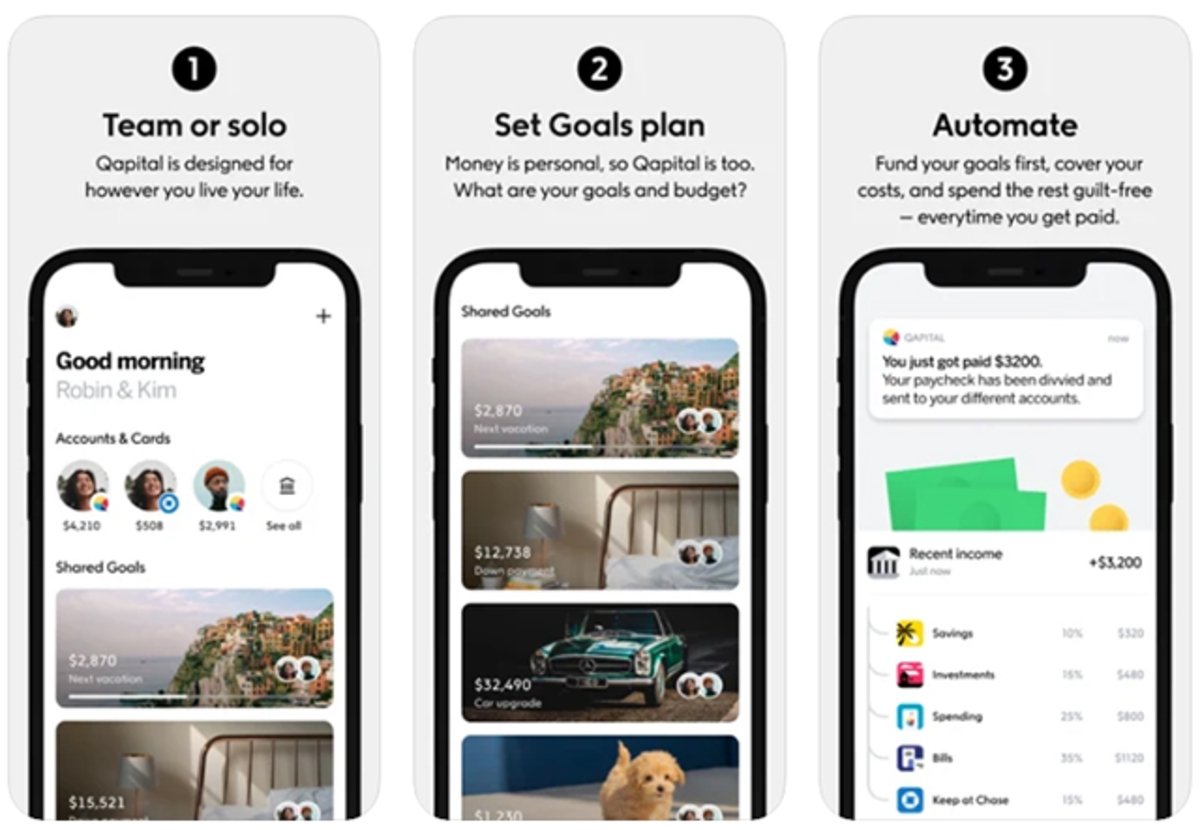

Qapital: Find Money Happiness

Qapital: adjusted savings plan

Qapital is one of the best applications to learn how to save from your iOS mobile. This software provides a savings plan adjusted for independent people or for couples. In this case, all you have to do is set a goal or objective, then the app will take care of providing the necessary tips to achieve it.

It contains an evaluation of daily expenses that you can verify and thus understand where the heaviest or most unnecessary expenses are made, only in this way can you act in favor of your financial objectives. It also provides a investment guidance and help you set good spending habits.

now you can secure your future Y reach your goals easily thanks to savings plan that these 8 applications for iPhone offer you.

Related topics: Applications

Sign up for Disney + for 8.99 euros and without permanence

Reference-ipadizate.com